Naramata winery passes on HST tax savings along to wine consumers

GlobalTV News visits Laughing Stock Vineyards to talk taxes – see video

Well, this is definitely one of those stories where you've got to look carefully to see the wine glass half-full. The move to the HST in BC has created no end of consternation and confusion, but in the end we'll all just be fine, methinks. In the case of BC wine, there is no doubt that the HST will reduce costs for winemakers, which hopefully can be passed along to avid consumers like us!

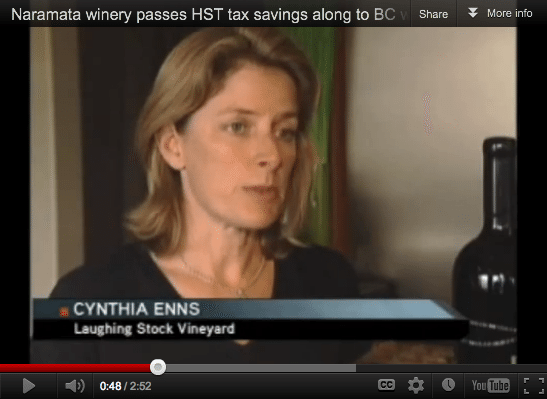

The first folks to stake their turf in the new "HST world of BC wine" are Naramata's Laughing Stock Vineyards. I say good for them – and who better to take this step than business folk-cum-winemakers like Cynthia & David Enns. They have a choice of whether to keep the same price markup that their BC liquor store competitors have. In the case of the latter, the government is requiring stores to increase the markup with the new tax, which makes the wine cheaper. So in essence, you're getting the same price as before when you buy at your local store.

However, the rules are thankfully different for dozens of BC wineries who sell directly to customers. They have a choice of whether to increase the markup. In the case of Laughing Stock they decided that it would be better to have a 3% lower price in their wine shop. What a great idea – and I bet they sell a lot more wine as a result!

So it looks like one winery in BC has thrown down the gauntlet. What other BC wineries will follow suit? Read the following press release from the winery…

Laughing Stock Vineyards Passes HST Tax Savings Along to Wine Consumer

New Harmonized Sales Tax Actually Means Lower Winery Pricing

While the upcoming introduction of the HST (Harmonized Sales Tax) in BC will cause the costs of many items to increase, BC wineries have the opportunity to pass those savings directly on to the consumer, thus decreasing the cost of BC wine when purchased directly from the winery.

Laughing Stock Vineyards has chosen to do just that and as of July 1st, 2010, will be passing along the 3% tax savings from the transition to HST to wine buyers on their website and in their tasting room. Currently, wine is one of the only products sold with taxes included in the display price and most consumers are not even aware that the current tax rate for wine in BC is 15% which includes 5% GST and 10% PST liquor tax. Therefore the taxation of wine will actually decrease when the 12% HST is introduced.

The BC Liquor Distribution Branch recently revealed there will be no tax savings passed through to the consumer as the LDB changed their liquor mark-up on all domestic and imported wine and spirits to offset that potential savings. BC wineries, however, are not affected by that new LDB liquor mark-up when they sell directly from the winery and thus have flexibility to adjust pricing to reflect the lower tax rate.

“Coming from a business background, we look at the big picture and since we have the option to decrease our pricing without hurting our bottom line, we are going to pass that tax savings along to the wine consumer,” says David Enns, winemaker and winery owner. “We just feel that this is the right thing to do. We eat it, you drink it.”

Visitors to www.laughingstock.ca and Laughing Stock’s tasting room on the Naramata Bench can expect to see price adjustments effective July 1st, 2010.